Fears of Coronavirus meant yields dropped again this week. Lately, whenever there’s fear and uncertainty in markets, investors turn to relatively safe bonds, causing yields to fall. Since the 1990s, though, yields have fallen in good and bad times alike. The normalization of cheap debt has changed how some economists think about running deficits. If yields stay low forever and America keeps growing, these economists reason that the United States government can safely run deficits every year.

But there is a risk that rates could increase, causing debt service payments to increase and crowd out other spending. To some extent, lower rates represent a structural change that will last. The population is older and has more savings. In a more global world, many governments desire safe assets to manage their currencies and hedge risk. There’s a finite supply of safe assets because only a few governments are seen as low risk. Bigger demand and fixed supply means higher debt prices (and lower yields). But that doesn’t mean yields will never rise again. Take a closer look at the buyers of debt and you will find some reason to worry that things could change.

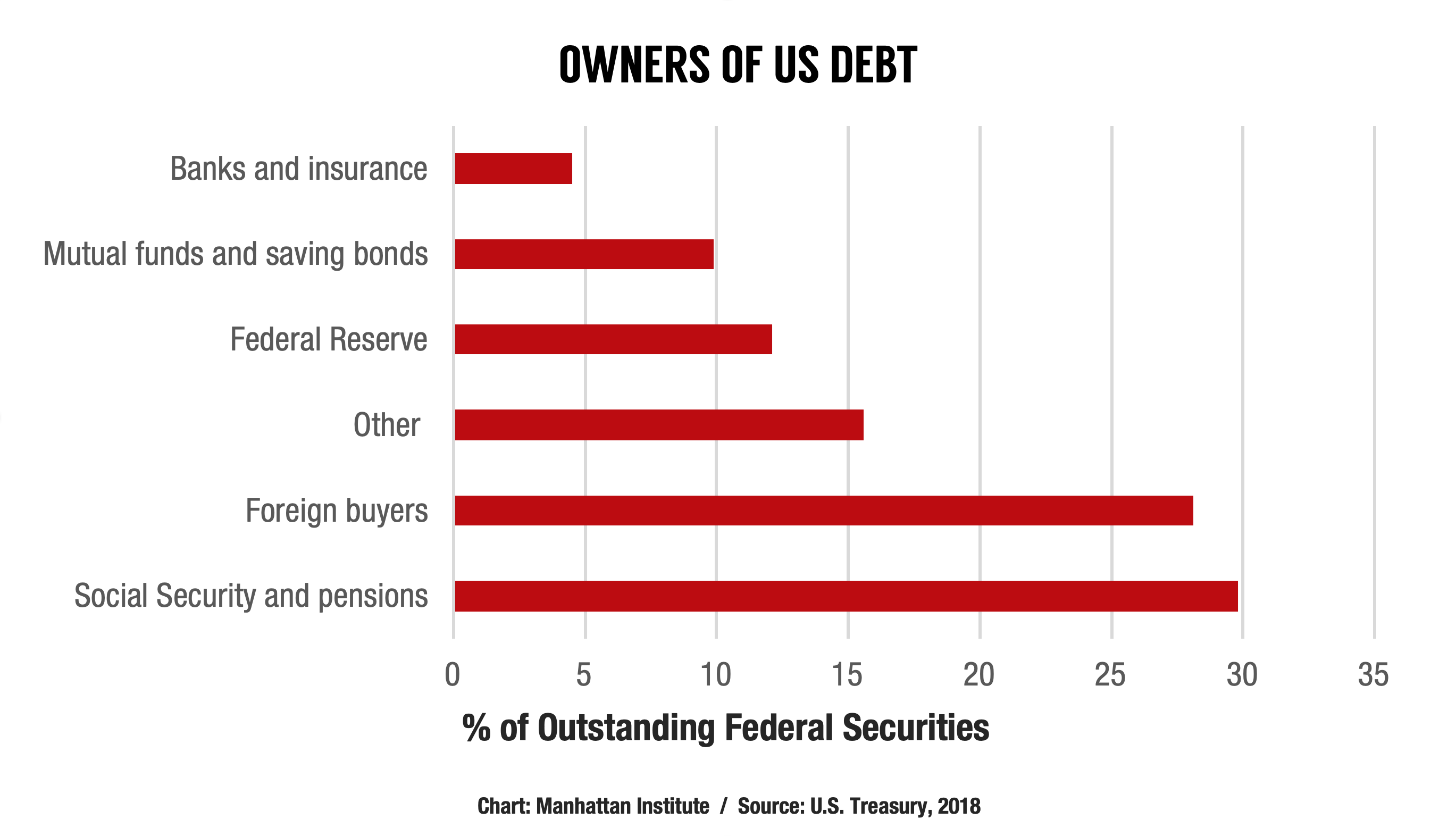

One big buyer of debt is the US government, mainly Social Security who buys special-issue bonds. As the trust fund dwindles, Social Security will not be able to continue buying debt, leaving a substantial vacuum on the demand side of the equation. The current level of foreign government demand is also not guaranteed. If trade slows and their populations age, Asian bond buyers will have less need for US assets as a tool for managing their currencies and risk exposure to the US market. It may make more sense for them to invest closer to home.

Shrinking demand would mean higher bond yields and higher bond yields would mean an end to the low rate world to which the US has become accustomed.

Allison Schrager is a senior fellow at the Manhattan Institute. Follow her on Twitter here.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, e21 delivers a short email that includes e21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the e21 Morning eBrief.

Photo by marchmeena29/iStock