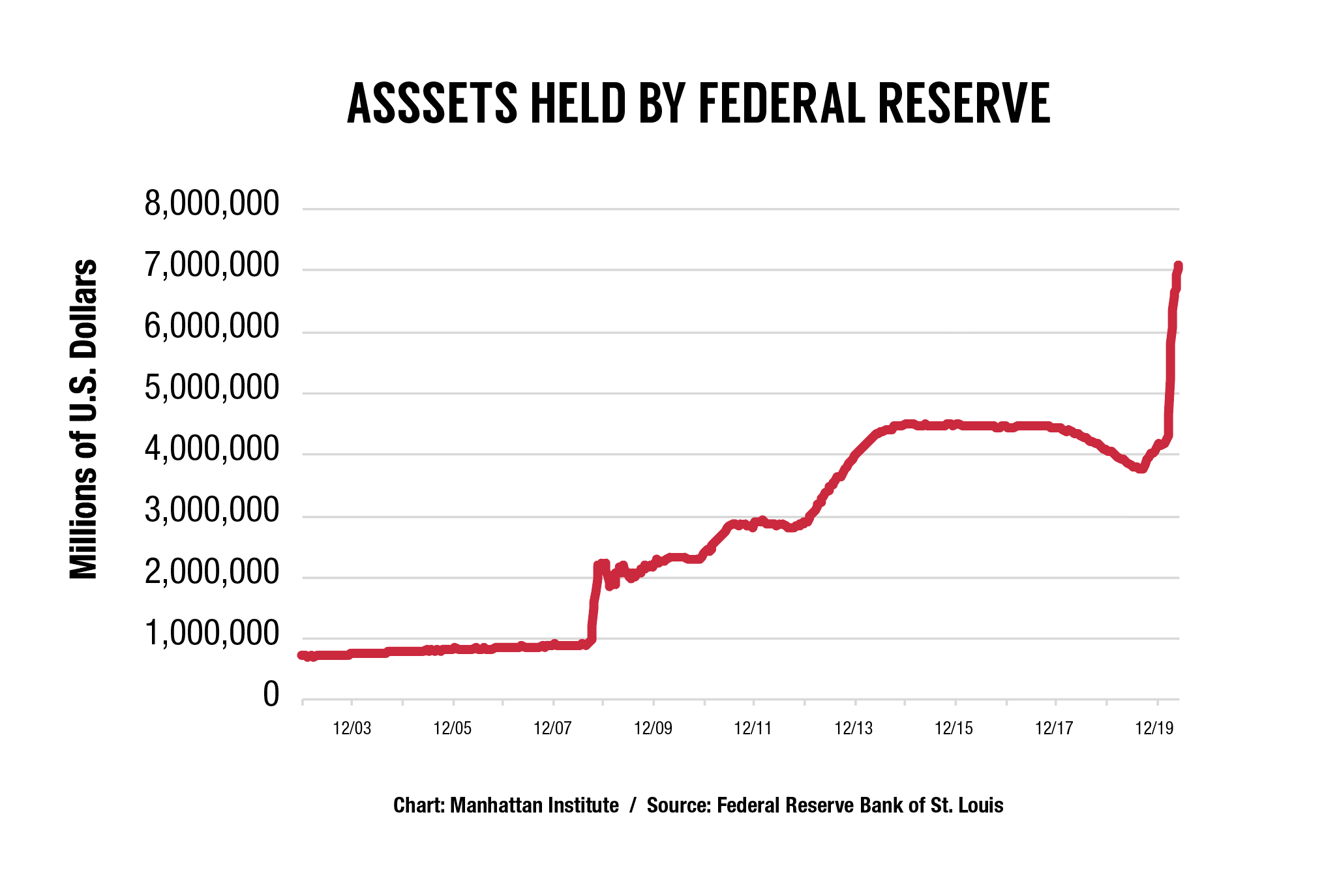

Extraordinary times call for extraordinary measures. The last twelve years included two extra-ordinary events where the Federal Reserve board undertook unprecedented action and bought trillions of dollars worth of assets. The benefits and costs of Quantitative Easing are still not completely understood. But one thing is clear, with every crisis the Fed's balance sheet grows and stays very large. Normalization never happened after the last crisis, and now the balance sheet is more than $7 trillion. At our Shadow Open Markets Committee event last week, experts discussed balance sheet normalization, when it should happen, if ever. One thing is clear, we are in unchartered territory for monetary policy. Though it may be our new normal.

Extraordinary times call for extraordinary measures. The last twelve years included two extra-ordinary events where the Federal Reserve board undertook unprecedented action and bought trillions of dollars worth of assets. The benefits and costs of Quantitative Easing are still not completely understood. But one thing is clear, with every crisis the Fed's balance sheet grows and stays very large. Normalization never happened after the last crisis, and now the balance sheet is more than $7 trillion. At our Shadow Open Markets Committee event last week, experts discussed balance sheet normalization, when it should happen, if ever. One thing is clear, we are in unchartered territory for monetary policy. Though it may be our new normal.

Allison Schrager is a senior fellow at the Manhattan Institute. Follow her on Twitter here.

This post was adapted from remarks given at the Manhattan Institute's Shadow Open Markets Committee Event. The event can be seen in its entirety here.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, e21 delivers a short email that includes e21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the e21 Morning eBrief.

Photo by Alex Wong/Getty Images