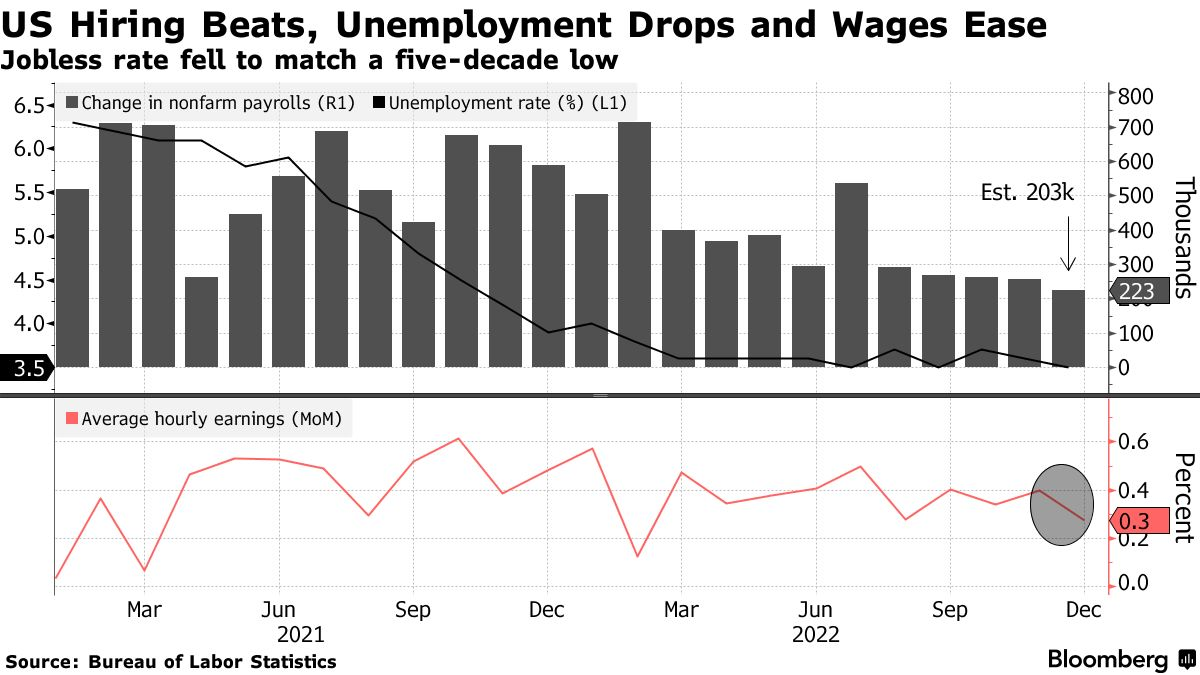

The Bureau of Labor Statistics reported in their December release that nonfarm payrolls increased 223,000 last month (above expectations) and the unemployment rate fell to 3.5 percent (with higher labor force participation). Most importantly, average hourly earnings rose 0.3 percent from a month earlier—lower than expectations. The relatively slow wage growth suggests that inflation is less likely to get entrenched in wages. In general, this data release hints that the “goldilocks” scenario for the Federal Reserve—lowering inflation without excessively hurting growth and the labor market—is more feasible than initially thought. Stocks and Treasuries rallied and the dollar dropped, as the market is beginning to price in a more dovish rate path. Specifically, swaps markets show that investors expect the baseline interest rate to stay below 5 percent, lower than the market thought just last week. One piece of data is still not enough evidence to convince Fed Chair Powell and his colleagues that inflation is truly declining; the CPI release this week will help paint a fuller picture.

Source: Bloomberg

Thomas Triedman, a sophomore at Yale, is a Summer 2022 Collegiate Associate at the Manhattan Institute

Interested in real economic insights? Want to stay ahead of the competition? Every Wednesday, e21 delivers a short email that includes e21 exclusive commentary and the latest market news and updates from around the Web. Sign up for the e21 Weekly eBrief.

Photo by Nuthawut Somsuk/iStock