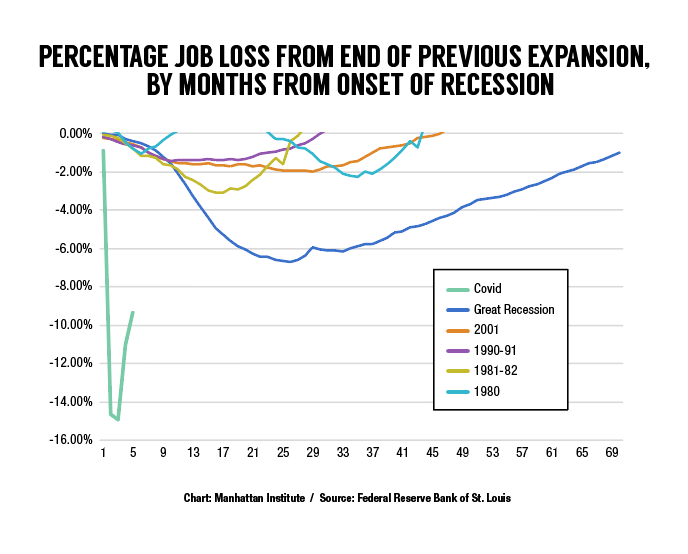

As a labor economist, I follow the data releases on the state of the economy pretty closely, especially the ones that tell us something about employment. Despite having pored over the numbers each week, I was still taken aback when I saw a graph (very similar to the one recreated here) in an opinion piece by Catherine Rampell published in The Washington Post. The graph illustrated unequivocally just how severely our labor market has suffered from the COVID pandemic. This is no ordinary recession.

As a labor economist, I follow the data releases on the state of the economy pretty closely, especially the ones that tell us something about employment. Despite having pored over the numbers each week, I was still taken aback when I saw a graph (very similar to the one recreated here) in an opinion piece by Catherine Rampell published in The Washington Post. The graph illustrated unequivocally just how severely our labor market has suffered from the COVID pandemic. This is no ordinary recession.

There are 13 million fewer jobs in the domestic economy today than in February, the month prior to the onset of economic closures and other efforts taken to thwart COVID in early March. That’s an eight percent reduction in the number Americans bringing home paychecks each week. With such a massive contraction, it comes as no surprise that the rate of unemployment has skyrocketed from 3.5 percent in February, a 50-year low, to over 10 percent, a level of joblessness that hasn’t been seen since the early 1980s. The scale of job loss has been massive.

But it is not just the magnitude of the disruption that makes the COVID recession unique. The cause of the contraction, an abrupt and unanticipated stoppage of vast swaths of economic activities, is wildly different in nature from previous economic downturns in the nation’s history. In fact, it’s precisely this characteristic of the downturn that made many economists and other observers hopeful that we’d be able to experience an equally abrupt recovery—the so-called “v-shaped recovery.” Had our battle to contain COVID been effective, the v-shaped recovery might have been possible, with the jobs that had been put on temporary hold returning as before, some with help from PPP loans, and only a minimal amount of permanent displacement and closure resulting from the disruption.

At this point, our nation continues to be engaged in an unexpectedly lengthy battle with COVID. Since our collective policies and actions have yet to contain the virus sufficiently, the return to “business as usual” that would enable a rapid return to normal economic activity and the longed-for v-shaped recovery remains impossible.

There is a nearly unanimous belief that we will ultimately conquer the virus and its hold on our economy. But the longer that it takes, the more permanent the damage that will be done. For example, if businesses had been required to close for just a few weeks, many could have withstood the disruption, perhaps with help from federal or state programs, and could have brought their operation back online with the same or most of the same workers. If the pause on activity had been just a bit longer, those same businesses might have had to lay off workers but been able to reopen, perhaps with a new staff, in short order. But the longer they are required to tread water, the more of them will have to close their doors for good, taking with them the jobs they had contributed to the economy.

The same dynamic is at play for individuals. Some might be able to withstand a few weeks of suppressed income, but as the length of time goes on, individuals and families will have to make accommodations, like selling their homes or relocating, leaving them farther behind financially than they would have been otherwise. Many parents may suffer a setback in their career as they struggle to make arrangements for children who cannot yet return to in-person schooling. The actions that will be necessary for some households in the short run will have lasting effects on their financial wellbeing.

The goal of policy interventions today should be to minimize this sort of “scarring” that will come from leaving the economy largely offline as we battle COVID, while simultaneously supporting efforts to develop a vaccine and a plan for rapid distribution. This could be achieved through the extension programs that were initially rolled out through the CARES Act, including PPP loans to businesses and the supplemental unemployment insurance benefits for displaced workers. However, these programs will need to be tweaked to account for the change in circumstances since the initial passage of that emergency legislation. PPP loans should be granted with greater flexibility, so that companies can use the funds to pay for whatever expenses threaten their survival. Likewise, the supplemental unemployment insurance benefits should be redesigned to allow for the improving economic conditions by pegging subsidy levels to local economic indicators and lowering the benefit to a level that does not hinder reemployment efforts when jobs do become available.

You don’t need to be a Keynesian to get behind this approach. These efforts aren’t about stimulating the economy, but rather keeping it intact until COVID releases the stranglehold on our nation. These interventions will be expensive, but if they prevent the destruction of businesses and individual wealth that would otherwise be caused by a prolonged stoppage then they will ultimately pay for themselves.

Beth Akers is a senior fellow at the Manhattan Institute and a former Council of Economic Advisors economist. Follow her on Twitter here.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, e21 delivers a short email that includes e21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the e21 Morning eBrief.

Photo by Jon Raedle/Getty Images