When it comes to your personal finances, how much is under your control? Standard financial literacy education preaches that you can take control over your finances and that you can save, invest, and perhaps one day buy a house, retire, or at least weather those inevitable financial shocks, like when you lose your job or your car breaks down. But there is a curious growing backlash to this message of empowerment. Economist at Equitable Growth Kate Bahn in The New York Times says she’s “frustrated” with financial literacy because she says it de-emphasizes structural impediments to financial success—like labor market concentration—which she believes is a driver of lower wages (the evidence is actually iffy on that one). The Times says:

Dr. Bahn’s argument is that personal finance is necessary, but not sufficient. It’s put forth as a solution when policy is what’s really needed, she said, and places priority on personal choice over issues that are, unfortunately, out of most people’s control.

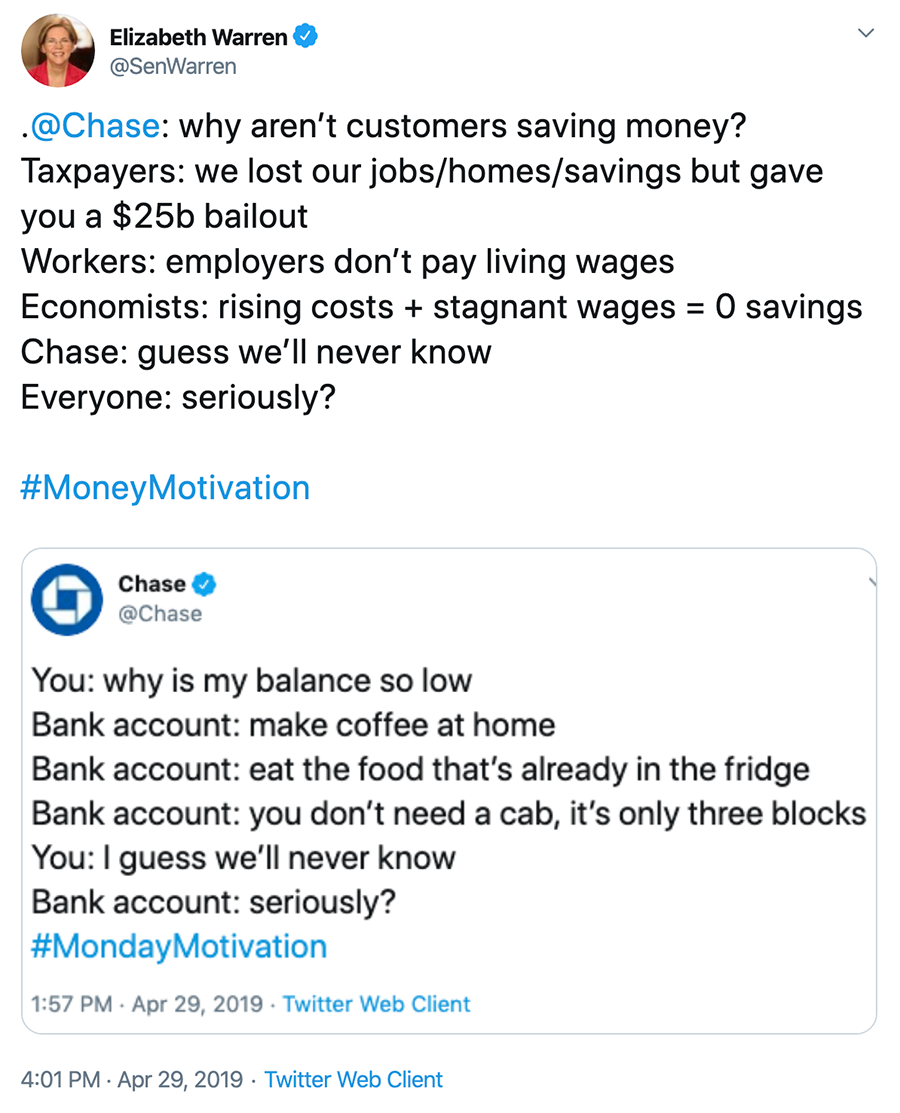

She is not alone in her skepticism that Americans have considerable power over their financial lives. Last April, Twitter erupted when Chase tweeted that people should be mindful of their spending and save more. Given public skepticism and still-simmering anger over the financial crisis, Chase might not be the best messenger. But it is still good advice: most of us do need to be more mindful of our spending. Yet Elizabeth Warren tweeted in response:

It’s true, American households face new challenges and sources of uncertainty that are beyond their control. Wage growth has been sluggish for many households, while the cost of housing education, and health care, continue to rise. The labor market is changing and technology always threatens to make many jobs obsolete. But all these changes call for greater financial literacy and messages of financial empowerment, not less. People are capable of learning how to manage risk decisions and navigate the new economy. To say otherwise is not only wrong but also patronizing to households with the desire and drive to do better.

First of all, despite rising health care and housing costs, American households continue to spend on many different things and many have room to save more too. The figures below, from the BLS Consumer Expenditure Survey, show the average American household spends about 78% of its pre-tax income (90% of post-tax)—a figure that’s trending downwards over time—meaning households are saving slightly more. Education, health care, and housing certainly dominate spending, but those areas are not using up all their spending. There is always room to re-budget.

It is true, however—and not surprising—that families with lower income have lower or negative saving rates because their income can’t cover many of their expenses.

Again, this is why such folks need more financial education. It’s not fair, but the less money you have, the less room you have to make financial mistakes. Low income—and even many middle-class families are extremely vulnerable to a spate of bad luck like a job loss, divorce, or health issue.

Financial literacy critics might prefer the government to reduce these risks further. And expanding the social safety net may be desirable for some shocks, but is not desirable or sufficient for everything. For example, the costs of divorce can be one of the biggest financial setbacks households face in their lifetime. Financial shocks tend to be too idiosyncratic to be met with a government program, and too comprehensive a safety net creates moral hazard. At some point personal savings needs to play a role as it provides the flexibility and independence Americans need. Insisting that the economy is stacked against you only breeds helplessness and poor decision making.

Mindful spending, for all income levels, is important. So is learning about credit, which is critical in order to access loans at low rates when taking on debt is unavoidable. Financial literacy can also help people from being taken advantage of, which has become a bigger risk in the new economy. Evidence exists that financial literacy helps with all of these things. Research based on literacy programs around the world from economists Olivia Mitchell and Annamaria Lusardi argues that good programs, tailored for their audience, increase saving and enhance stock market participation and the ability to make good financial decisions.

Knowledge and the belief you have control over your finances are critical for success in the modern economy. Pushing back on financial literacy’s core message in order to push a political agenda is what’s irresponsible.

Allison Schrager is a senior fellow at the Manhattan Institute.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, e21 delivers a short email that includes e21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the e21 Morning eBrief.

Photo by RichVintage/iStock