The stock market does not make much sense these days. The global economy is facing the biggest economic shock in recent memory (including the 2008 financial crisis). The outlook ahead is uncertain at best, yet the S&P 500 is only down 7% from its February highs.

The stock market does not make much sense these days. The global economy is facing the biggest economic shock in recent memory (including the 2008 financial crisis). The outlook ahead is uncertain at best, yet the S&P 500 is only down 7% from its February highs.

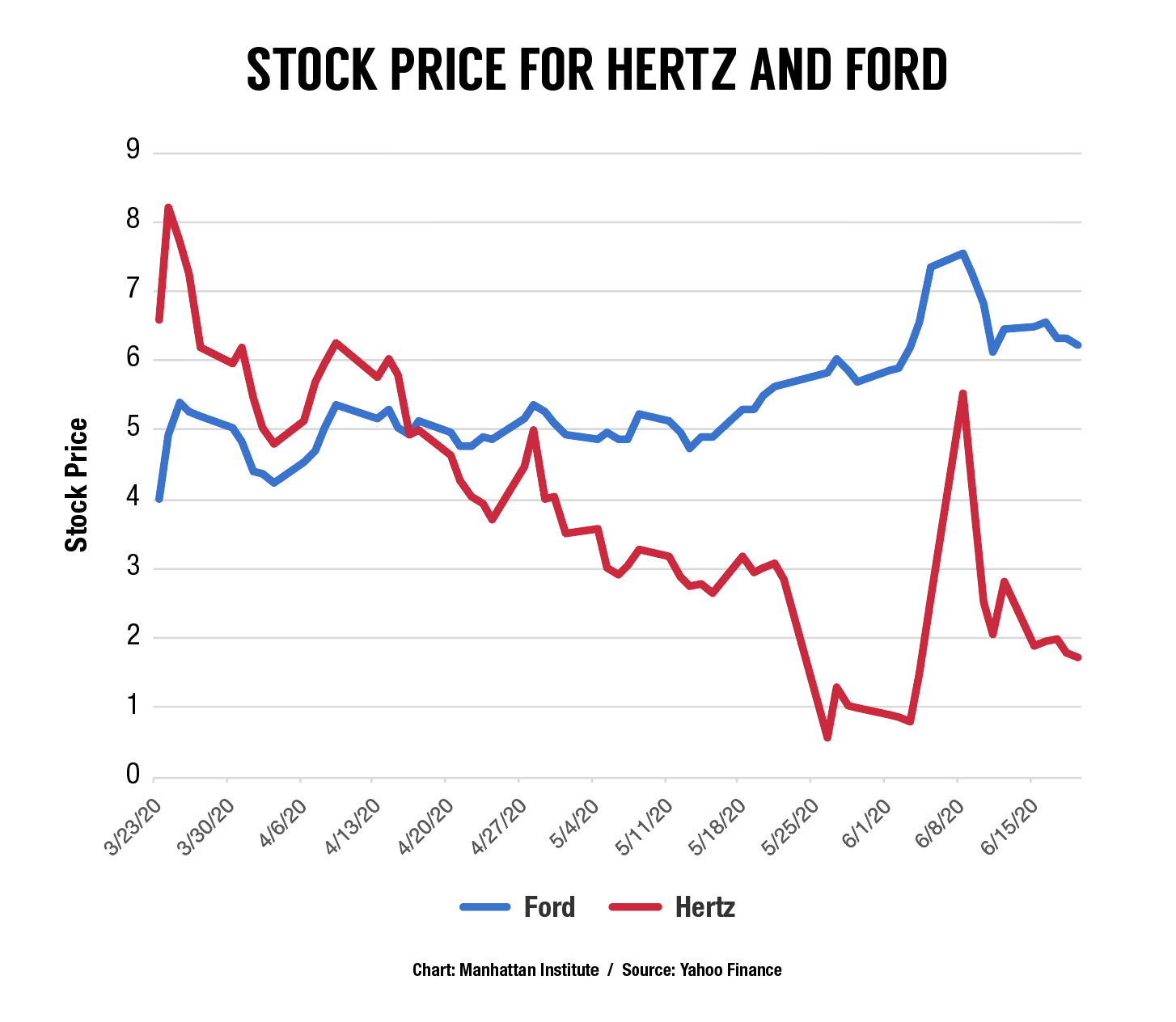

Even more baffling is the price of Hertz stock. The company declared bankruptcy on May 22 and on June 8 the stock was up 5 fold—nearly as valuable as Ford motor company. Many market commentators are blaming a new generation of day traders, young sports fans with too much time and energy who've turned to the stock market to replace sports betting in their lives. But the size of this market is too small to move markets. The entire sports betting industry was $155 billion in 2018, a fraction of the assets under management at many single institutional investors. Odds are the new day traders are not moving markets so much as losing their own money.

So what can explain the stock market? It may reflect optimism the economy will improve. When times are uncertain and the market trying to find the future path of the global economy, any small amount of data can move markets.

What about Hertz? Some investors may think that Hertz's prospects are good, that it can come out of bankruptcy and with a fleet of cars that has more value. Or buying the stock could be part of a more sophisticated investment strategy.

Allison Schrager is a senior fellow at the Manhattan Institute. Follow her on Twitter here.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, e21 delivers a short email that includes e21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the e21 Morning eBrief.

Photo by Adam Glanzman/Getty Images