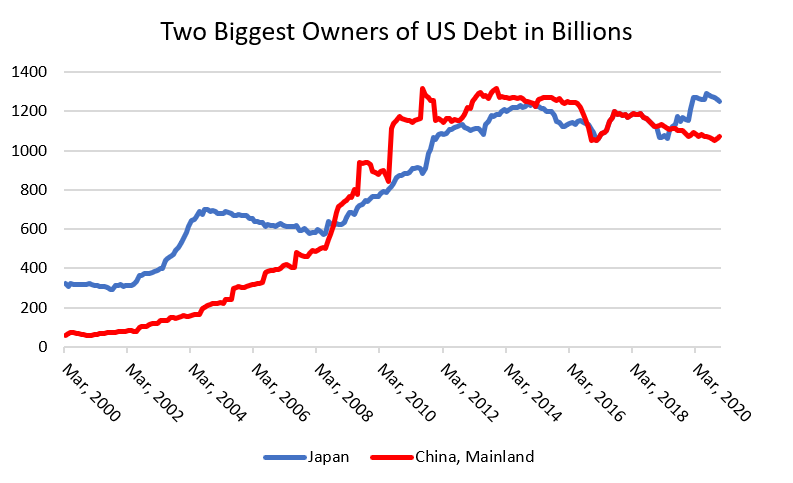

Interest rates have remained low (at least by historical standards) despite ballooning debt levels for several reasons. A big one is foreign investors and governments appeared to have an insatiable appetite for US treasuries. As we ponder adding to our entitlement state, it is important to consider if we can count on investors willing to buy US debt no matter the price. The two biggest buyers of US debt are Japan and China. The figure below shows their debt holdings in billions of dollars. While Japan's demand appears to be holding steady, China's US debt holdings have leveled off and then declined in recent years. Debt markets have mostly shrugged this off. In large part because the Fed has become the big buyer of treasuries. But as it ponders tapering, or even a rate increase, it and China may no longer be a reliable buyer anymore.

Source: US Treasury

Allison Schrager is a senior fellow at the Manhattan Institute. Follow her on Twitter here.

Interested in real economic insights? Want to stay ahead of the competition? Every Wednesday, e21 delivers a short email that includes e21 exclusive commentary and the latest market news and updates from around the Web. Sign up for the e21 Weekly eBrief.

Photo by pabradyphoto/iStock