This is based on testimony delivered to the House Financial Services Committee on April 4, 2017. The full testimony can be found here.

The Fed has failed to achieve its central objectives – price stability and financial stability – during about three-quarters of its one hundred years of operation. Although the Fed was founded primarily to stabilize the panic-plagued U.S. banking system, since the Fed’s founding, and largely as the result of errors in Fed monetary and other policies, the U.S. has continued to suffer an unusually high frequency of severe banking crises, including during the 1920s, the 1930s, the 1980s, and the 2000s. The two major U.S. banking crises since 1980 place our country within the top quintile of risky banking systems in the world – a distinction it shares with countries such as Argentina, Chad, and the Democratic Republic of Congo.

It is high time to address deficiencies in our financial system that have produced these subpar results, and one of the key areas where reform is needed is in the governance of the Fed. The Fed has played an active role in producing most of those crises, and its failure to maintain financial stability has often been related to its failure to maintain price stability.

In his review of Fed history, Allan Meltzer points to two types of deficiencies that have been primarily responsible for the Fed’s falling short of its objectives: adherence to bad ideas, and politicization. Failures to achieve price stability and financial stability reflected a combination of those two deficiencies.

Unfortunately, the failures of the Fed are not merely a matter of history. Since the crisis of 2007-2009, a feckless Fed has displayed an opaque and discretionary approach to monetary policy in which its stated objectives are redefined without reference to any systematic framework that could explain those changes, has utilized untested and questionable policy tools with uncertain effect, has been willing to pursue protracted fiscal (as distinct from monetary) policy actions, has grown and maintains an unprecedentedly large balance sheet that now includes a substantial fraction of the U.S. mortgage market, has been making highly inaccurate near-term economic growth forecasts for many years, and has become more subject to political influence than it has been at any time since the 1970s.

The same problems that Meltzer pointed to – bad ideas and politicization – now, as before, are driving Fed policy errors. I am very concerned that these Fed errors may result, once again, in departures from price stability and financial stability.

The continuing susceptibility of the Fed to bad thinking and politicization reflects deeper structural problems that need to be addressed. Reforms are needed in the Fed’s internal governance, in its process for formulating and communicating its policies, and in delineating the range of activities in which it is involved.

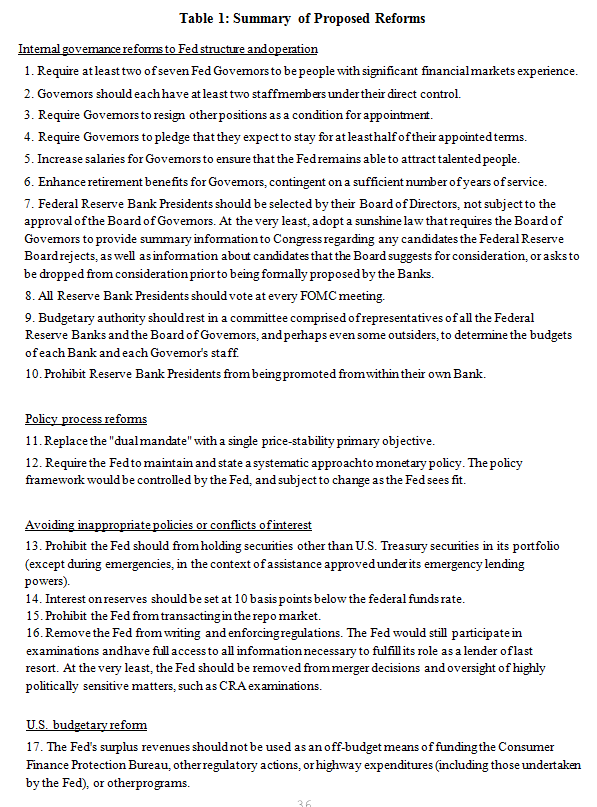

Reforms are needed to address those problems: (1) internal governance reforms that focus on the structure and operation of the Fed (which would decentralize power within the Fed and promote diversity of thinking), (2) policy process reforms that narrow the Fed’s primary mandate to price stability and that require the Fed to adopt and to disclose a systematic approach to monetary policy, and (3) other reforms that would constrain Fed asset holdings and activities to avoid Fed involvement in actions that conflict with its monetary policy mission.

Table 1 summarizes the reforms, and Figure 1 outlines the primary channels through which reforms would improve monetary policy.

Improving the Fed’s primary mandate to focus on price stability is a reform that is long overdue. Price stability is an achievable long-run objective, and thus, the Fed can be held accountable for achieving it. Indeed, long-run inflation is completely under its control. Inflation matters for growth. High levels of inflation, or volatile inflation, result in lower output and higher unemployment in the long run.

As Milton Friedman and many others have correctly argued for years, the reason to target price stability is not because we care about price stability per se (no one should), but rather, because we care about employment and output; by making price stability the primary long-run objective of the Fed we ensure that the average levels of output and employment will be maximized in the long run. Paradoxically, the point of narrowing the Fed’s long-term mandate to inflation is to boost average employment. Narrowing the Fed’s primary mandate makes the Fed more accountable while protecting it from myopic political pressures that are inherent in any democracy.

Holding the Fed primarily to account for price stability does not preclude it from supporting the economy during slumps with countercyclical policy over the short- or medium-terms, as a secondary objective. Indeed, a host of possible monetary policy strategies are consistent with both meeting a long-run inflation target, and providing countercyclical influence. There is no doubt that a Fed with a single inflation mandate would continue to execute countercyclical policy aggressively. By making that countercyclical process systematic, we would further ensure the appropriate accountability of monetary policy, while further insulating it from myopic political pressures or from “seat-of-the-pants” biases that cause monetary policy to fall short of its objectives.

Governance reform should also seek to avoid inappropriate Fed actions that are outside its monetary policy mandate, especially fiscal policies or actions that conflict with the Fed’s monetary policy mission. Most importantly, the Fed should be prohibited from fiscal actions related to purchasing and holding securities other than U.S. Treasury securities, from participating in the repo market, and from using the interest rate paid on reserves as a policy tool. None of these is necessary or appropriate for monetary policy.

The Fed’s role in regulation also should be circumscribed, as envisioned in the 2008 Treasury blueprint. Doing so would eliminate a major source of unhealthy political pressure on the Fed. In particular, regulatory responsibilities in the areas of merger approvals and CRA examinations – which are lightning rods for politicizing the Fed – should be moved elsewhere.

We need to improve the deliberative process at the Fed by making it more democratic, and by ensuring true diversity of thinking. The Fed has lost the diversity of experience and perspective that used to animate and inform its debates. Power has become excessively centralized and dissents are increasingly rare. There is an urgent need to fix these problems. Table 1 lists ten specific improvements to the process of choosing Fed leaders, and measures that would empower those leaders, which together would ensure that diverse and informed perspectives are meaningfully represented in Fed policy debates.

Charles Calomiris is the Henry Kaufman Professor of Financial Institutions at Columbia Business School, a professor at Columbia University’s School of International and Public Affairs, an adjunct fellow at the Manhattan Institute, and a member of the Shadow Open Market Committee.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, E21 delivers a short email that includes E21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the E21 Morning Ebrief.