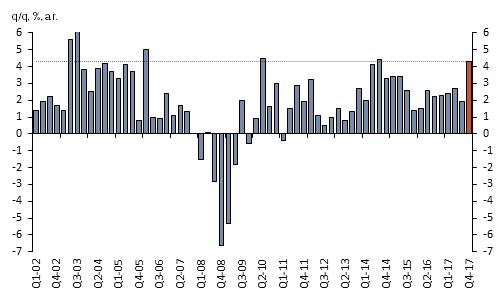

Real final domestic demand —consumption plus fixed investment and government purchases not including inventory change and changes in exports and imports —advanced by an exceptionally strong 4.3 percent in the fourth quarter, the third fastest pace in this economic recovery and faster than all but three quarters in the prior expansion (see chart below). There was a synchronized improvement in real growth across sectors: business fixed investment (7 percent annualized), residential fixed investment (12 percent), government purchases (3 percent) —the best gain since the second quarter of 2015, and private consumption (4 percent).

U.S. Real Final Sales to Domestic Purchasers

Consumers willingly loosened their purse strings for the holiday shopping season and matching their elevated optimism, the personal savings rate fell to a low 2.6 percent in Q4, the third lowest in history (see chart below). Looking into 2018, increases in disposable incomes—stemming from employment gains, one-time bonuses and wage increases announced by companies, and changes in withholding schedules as part of the tax reform —will spur gains in consumer spending. We expect strong consumption to continue.

We project strong nominal and real GDP growth momentum in 2018. Nominal GDP growth over 5 percent and further unemployment rate declines are expected to push average hourly wage increase over 3 percent in 2018, an acceleration from 2.5 percent currently.

Net trade and inventories subtracted significantly from fourth quarter GDP, as imports surged 13.9 percent relative to the healthy 6.9 percent annualized increase in exports. The strength in imports reflects the very strong U.S. domestic demand — business investment as well as consumption. It is noteworthy that, while imports rose so rapidly, inventory building fell markedly from $38.5 billion to $9.2 billion, reflecting the strength in product demand.

The momentum in product demand and low inventories point toward strong production needs in 2018. In 2018, exports are expected to grow at a healthy pace, but imports are projected to grow faster, widening the trade deficit, reflecting continued strength in domestic consumption and investment. We also expect inventory rebuilding to pick up in coming quarters.

Residential investment rose 11.6 percent annualized in the fourth quarter of 2017, adding 0.4 percentage points to the real GDP growth, but that gain only offsets the declines in the second and third quarters. We project further gains in housing activity in 2018.

The 2018 first quarter GDP estimate will probably be affected by a statistical quirk. The first quarter estimate from the Bureau of Economic Analysis (BEA) tends to be biased downwards because of residual seasonality —seasonal trends that remain in the data despite seasonal adjustment. The BEA plans to correct for this residual seasonality in three stages that will be completed by July 2018. Nevertheless, we expect first quarter GDP growth to increase by 2.6 percent, but indeed the underlying trend is likely closer to 3 percent.

In response to the momentum in the economy and prospects for positive implications of the tax reform and fiscal stimulus, we expect the Federal Reserve to upgrade its 2018 GDP forecast again at its March meeting (and possibly its policy rate forecast as well). In its December 2017 updated forecast, the Fed forecast real GDP to grow 2.5 percent in 2018 Q4/Q4. In current circumstances, that seems very low.

Mickey Levy is the chief economist for the Americas and Asia of Berenberg Capital Markets, LLC, and member, Shadow Open Market Committee.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, E21 delivers a short email that includes E21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the E21 Morning Ebrief.