The Congressional Budget Office has issued a new report on the projected effects of terminating cost-sharing reduction subsidy payments under the Affordable Care Act, as President Trump has repeatedly threatened to do. These findings are counterintuitive and surprising.

CBO found that cutting off these payments would on balance tend to benefit low-income people (especially those nearing retirement age), albeit at considerable cost to taxpayers. Without agreeing or disagreeing with CBO’s projections, let me try to explain what it found.

First, the background: under the ACA, the federal government provides cost-sharing reduction (CSR) subsidies to sponsors of so-called “silver” insurance plans, based on the numbers of people enrolled in those plans with incomes between 100 percent and 250 percent of the federal poverty line. People in these income ranges get a higher share of their medical expenses paid by the insurer than the 70 percent average actuarial value received by other silver plan participants. In short, CSRs make silver plan coverage a substantially better value for people in this low-income range.

President Obama and the Republican Congress had a protracted tug of war over federal CSR subsidy payments. The ACA authorized them but Congress refused to appropriate funds for them. President Obama’s administration argued that the payments were lawful regardless of Congress’s refusal to appropriate funds, and the issue is still tied up in the courts. It has been conventional wisdom that these silver plans would be destabilized if insurers were denied CSR subsidies. Although the Trump administration has not acted to stop them, the implication that they could be cut off has been understood to be the means by which the president might fulfill threats to let the ACA “implode.”

Yesterday’s CBO report projected the results of terminating CSR subsidy payments. Some parts of their analysis are unlikely to surprise many observers. Other parts might be surprising.

The unsurprising part is CBO’s expectation that if CSR subsidies are withdrawn, sponsors of silver plans will hike premiums substantially.

The surprising part is that CBO found that not only would this generally not hurt low-income participants, it would on balance benefit them – especially older Americans below 400 percent of the poverty line. The primary losers, under CBO’s analysis, would be federal taxpayers. Add it all up, and terminating the CSR subsidies would paradoxically lead to a substantial increase in progressive income redistribution.

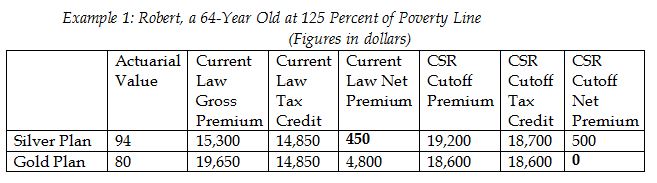

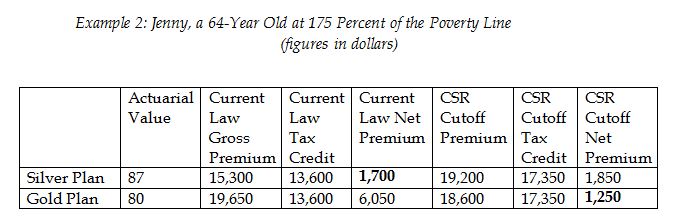

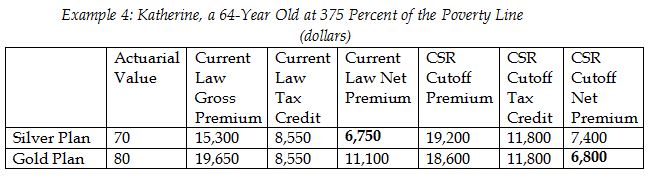

The essential reason for this is that rising premiums in silver plans would trigger an increase in tax credits for low-income individuals whose premium-paying responsibilities are limited by the ACA. CBO sees some individuals being made nearly whole by the larger tax credits, with others coming out substantially ahead. It is difficult to explain all this without using specific examples, so some are provided below. All of these are taken directly from the CBO report. The examples here are for 64-year-olds, for whom the financial implications are greater relative to younger individuals. The illustrations provided by CBO are for 2026.

CSRs enable Robert to receive higher actuarial value (94 percent) from a silver plan than a gold (80 percent) plan. Robert’s tax credit maxes out at $14,850, which leaves him with a net premium cost of $450 for a silver plan but $4,800 for a gold. If the CSR subsidies are cut off, the gross premium costs for a silver plan would rise –but his tax credit would rise nearly in tandem with it. As a result, his net premium for a silver plan would rise by only about $4 a month (from $450 to $500), while he would now have the option of making no net premium payments at all for a gold plan that previously would have cost him $4,800.

The situation is similar for Jenny, at 175 percent of the poverty line. CBO foresees a gold plan becoming substantially less expensive for this individual than either the silver or gold plan would be under current law.

One could argue whether Jenny would be better or worse off. She would have to pay more to stick with her current plan, but she would also have the option of substantially lowering her premium costs while still participating in a strong gold plan.

There’s no question but that CBO sees David in the next example as being made substantially better off by a CSR subsidy termination.

David would thereafter have the option of paying a lower net price ($2,750) while moving into a plan offering greater actuarial value (up to 80 percent from 73 percent). That’s a clear win for David from multiple angles.

Katherine would also come out ahead. Under CBO’s projections, she would now have the option of enrolling in a gold plan for a net premium of $6,800, far less than the $11,100 charged under current law, and nearly the same as she would pay under current law for a silver plan of substantially lesser actuarial value.

If Robert, Jenny, David, and Katherine would benefit from terminating CSR subsidies, who would be the losers? Under CBO estimates, the answer is straightforward: federal taxpayers. CBO finds that terminating CSR subsidies would add $194 billion to federal deficits over the next ten years.

Also of interest is CBO’s assessment that, contrary to widespread belief, cutting off CSR subsidy payments would not precipitate a marketplace death spiral. CBO anticipates some disruptions arising from market uncertainty over the next couple of years, but beyond that it says “the nongroup insurance market would. . . continue to be stable in most parts of the country.”

Perhaps the most interesting finding of all is that CBO expects total insurance coverage to somewhat increase over the long term if CSR subsidies are terminated. Specifically, CBO projects that the number of people uninsured will be “slightly lower starting in 2020.”

In sum, CBO expects that cutting off CSR subsidies would have directional effects consistent with the ACA itself – that is, increasing total subsidy payments, total federal costs, income redistribution from rich to poor, and the numbers of individuals carrying insurance. These budgetary effects are opposite those of the recently-considered Senate and House bills, which would have reduced federal costs as well as coverage enrollment projections. Partisans who hysterically charged that repealing the ACA equated to sentencing people to death would logically have to say the same thing about continuing CSR subsidies, crazy though that is.

I have no idea whether CBO is right. It is interesting, precisely because it is so counterintuitive, that CBO has projected that terminating CSR subsidies would actually lead to the federal government spending more money, providing low-income people with more affordable insurance coverage options, and even increasing insurance enrollment.

Charles Blahous is a senior research fellow for the Mercatus Center, a research fellow for the Hoover Institution, and a contributor to e21. He recently served as a public trustee for Social Security and Medicare.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, e21 delivers a short email that includes e21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the e21 Morning eBrief.

iStock Photo