This is a recession unlike any other. Many have lost their jobs, but they are also getting unprecedented support from the government. Meanwhile, there is not much scope to spend money on vacations, work clothes, or dinners out. It is not surprising that personal saving rates spiked in April to more than 33% and remained elevated, at 12.1% in November. In normal times before the pandemic the saving rate was about 6 or 7%. Saving rates normally increase during a recession. People become more cautious about the economy and cut back on spending. But even during the financial crisis the saving rate never got far above 8%.

This data suggests that despite the economic stress, many household balance sheets are in good shape and primed to spend with the economy fully reopens. We may be in for a strong recovery. It also suggests there is not much need for the $2000 stimulus check. The median household is saving, building wealth and not spending. Some households, who lost jobs or their businesses, do need support. But it is better to target them more directly.

Allison Schrager is a senior fellow at the Manhattan Institute. Follow her on Twitter here.

Interested in real economic insights? Want to stay ahead of the competition? Each weekday morning, e21 delivers a short email that includes e21 exclusive commentaries and the latest market news and updates from Washington. Sign up for the e21 Morning eBrief.

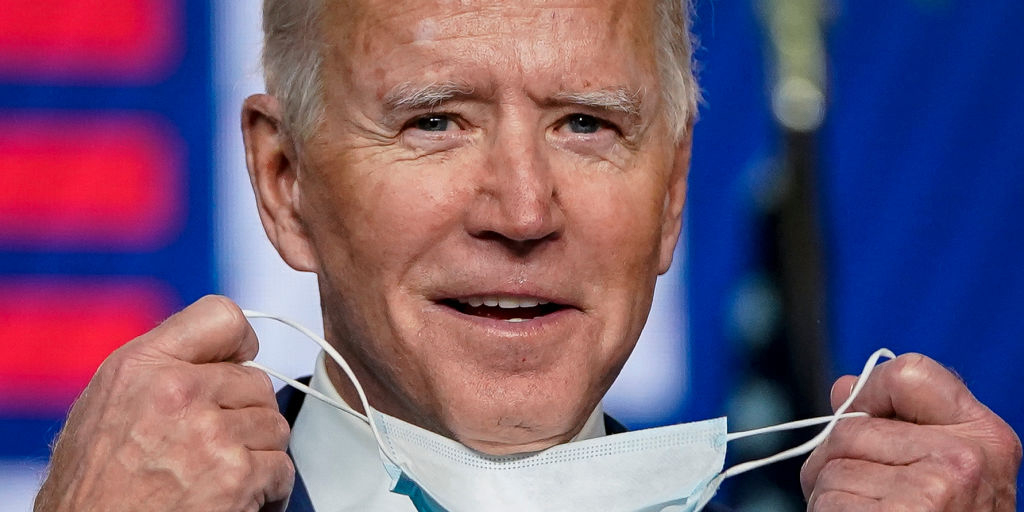

Photo by Drew Angerer/Getty Images