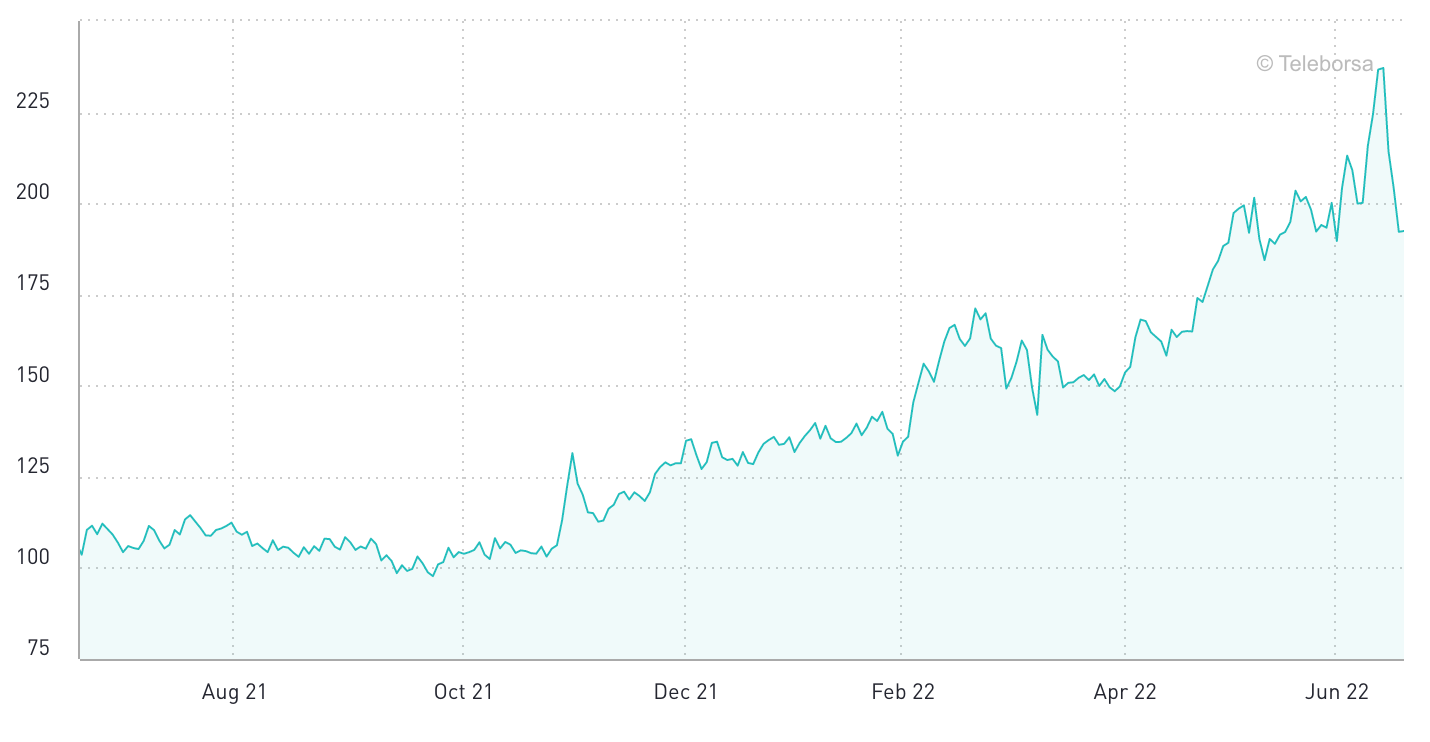

The spread between the yield on Italian debt—considered by investors to be among the riskiest debt in Europe—and German debt—considered the safest—has quickly widened as market participants begin to anticipate higher ECB rate hikes in response to high inflation figures. Investors are building a relatively high default premium into the price of Italian debt and are seeking to be compensated more for marginal risk, scared off by Italy’s slow economic growth and swelling debt load (which is, worse yet, held mainly by Italian banks). Worsening financial conditions in these debt-heavy countries—Greece is another example—present the ECB with a tough choice: Hike to prevent inflation expectations from drifting upward or ease up out of concern for countries like Italy. However, European central bank members have verbally committed to easing this fragmentation, suggesting that the trade-off between inflation and economic growth in the Euro-area might not be as straightforward as it seems. Although the ECB has a particularly hard job (partially because they preside over different economies without a fiscal union), the U.S. Fed faces a similar dilemma between managing financial conditions and controlling inflation.

Bond Spread Italy BTP-BUND 10 years

Source: Borsa Italiana

Thomas Triedman, a sophomore at Yale, is a Summer 2022 Collegiate Associate at the Manhattan Institute

Interested in real economic insights? Want to stay ahead of the competition? Every Wednesday, e21 delivers a short email that includes e21 exclusive commentary and the latest market news and updates from around the Web. Sign up for the e21 Weekly eBrief.

Photo by ThitareeSarmkasat/iStock